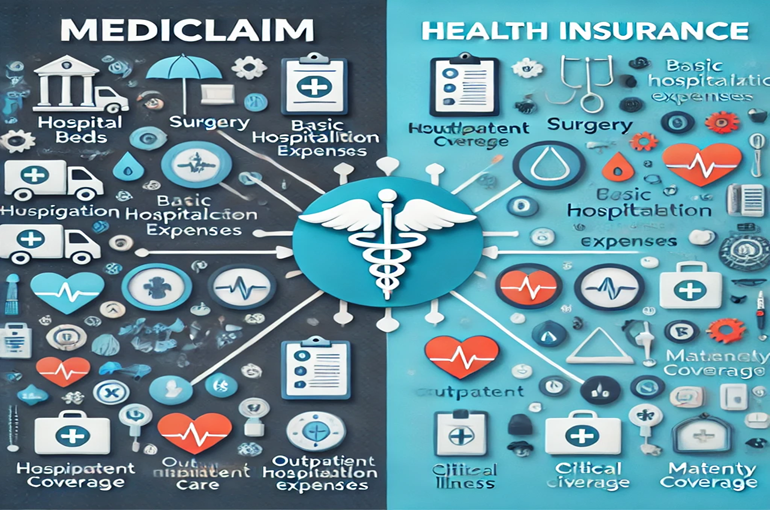

In today’s fast-paced world, securing financial protection against medical emergencies is crucial. But when it comes to choosing the right plan, many people often confuse Mediclaim with Health Insurance. While both aim to cover medical costs, they differ significantly in their coverage, flexibility, and overall benefits. Let’s dive deep into the differences to help you make an informed decision.

What is Mediclaim?

Mediclaim is a hospitalization-focused insurance policy designed to cover specific medical expenses such as hospital stays, surgeries, and treatments related to accidents. Its coverage is limited to hospitalization costs, meaning outpatient treatments (OPD) like doctor visits, diagnostic tests, or medication costs are not covered. Mediclaim is often more affordable due to this limited scope, making it a go-to option for those seeking basic protection for medical emergencies.

- Sum Insured: Typically, Mediclaim policies offer lower coverage, often capped at around ₹5 lakh.

- Claims: You can file multiple claims as long as they fall within the insured amount. However, it only covers expenses related to hospitalization.

- Premium: Mediclaim policies generally come with lower premiums, but that means the coverage is limited.

What is Health Insurance?

Health insurance offers comprehensive coverage, going beyond just hospitalization. It includes expenses related to day-care procedures, outpatient treatments, pre- and post-hospitalization costs, ambulance charges, and even critical illness cover. You can also customize health insurance policies with add-ons for things like maternity care or international coverage, making it a more versatile and flexible option.

- Sum Insured: Health insurance typically offers higher coverage, which can range from ₹50,000 to several crores.

- Claims: In addition to hospitalization, health insurance covers OPD expenses, critical illness treatments, and more. Claims can be made for a wider range of healthcare services.

- Premium: Due to the broader coverage, health insurance premiums are generally higher but offer significantly more protection.

Key Differences Between Mediclaim and Health Insurance

- Scope of Coverage: Mediclaim focuses solely on hospitalization and treatment for accidents and certain illnesses, while health insurance provides all-around medical coverage, including outpatient care, pre- and post-hospitalization expenses, and more.

- Sum Insured: Mediclaim policies are more affordable but come with a lower sum insured, usually up to ₹5 lakh. On the other hand, health insurance policies can offer coverage up to several crores, making them more suitable for serious and long-term medical needs.

- Customizability: Health insurance allows a lot of flexibility with add-ons like maternity benefits, critical illness coverage, and global coverage, whereas Mediclaim plans are generally fixed and non-customizable.

- Premium Costs: Mediclaim is a budget-friendly option but comes with limited coverage. Health insurance has higher premiums due to its extensive benefits, but it offers comprehensive financial protection.

- Hospitalization Requirement: With Mediclaim, you must be hospitalized to avail of the coverage, whereas health insurance can cover day-care procedures that don’t require hospitalization.

- Critical Illness and Add-ons: While Mediclaim policies do not cover critical illnesses like cancer or stroke, health insurance policies often include these or offer them as add-ons.

- Cashless and Reimbursement Options: Both Mediclaim and health insurance offer cashless treatment at network hospitals, but health insurance often has a broader network and covers a wider range of treatments.

Which One Should You Choose?

The decision between Mediclaim and Health Insurance depends on your healthcare needs and budget. If you’re looking for basic coverage for hospitalization without breaking the bank, Mediclaim might be sufficient. However, if you want comprehensive coverage that includes outpatient treatments, critical illnesses, and more, investing in a health insurance plan is the smarter choice.

Mediclaim may suit:

- Individuals on a budget.

- Those looking for basic hospitalization coverage.

- People with limited medical needs and no pre-existing conditions.

Health Insurance is ideal for:

- Families needing comprehensive healthcare coverage.

- Individuals seeking customization with critical illness or global coverage add-ons.

- Those who want coverage for day-care procedures, OPD, and pre- or post-hospitalization costs.

Final Thoughts

In an era of rising medical costs, having some form of protection is essential. Mediclaim is a solid starting point if you’re looking for affordable coverage focused on hospitalization. However, if you want peace of mind and more extensive protection, health insurance is a better, albeit more expensive, option. Make sure to evaluate your medical history, family needs, and budget before making a decision.